Irs Fsa Carryover Limit 2024

Irs Fsa Carryover Limit 2024. The internal revenue service (irs) announced new cola adjustments and maximum fsa contribution limits for 2025. However, the irs allows you to keep a certain amount from year to year.

For fsas that allow unused funds to carryover into the next year, the maximum that can be carried over from 2024 to 2025 is $640, which marks a $30 increase from this. For health fsa plans that permit the carryover of.

For Cafeteria Plans That Allow The Carryover Of Unused Amounts, The Maximum Carryover Amount For 2024 Is $640.

On november 10, via rev.

However, The Irs Allows You To Keep A Certain Amount From Year To Year.

Irs fsa carryover to 2024 jess romola, on.

Irs Fsa Carryover Limit 2024 Images References :

Source: angeophelie.pages.dev

Source: angeophelie.pages.dev

Fsa Limits 2024 Per Person Denni Felicia, The 2024 medical fsa contribution limit will be $3,200 per year, which is a $150 increase from 2023. The 2024 maximum fsa contribution limit is $3,200.

Source: ingerqelberta.pages.dev

Source: ingerqelberta.pages.dev

Max Fsa Contribution 2024 Irs Tessa Gerianna, 1, 2024, the contribution limit for health fsas will increase another $150 to $3,200. The irs set a maximum fsa contribution limit for 2024 at $3,200 per qualified fsa ($150 more than the prior year).

Source: dalilaqjillene.pages.dev

Source: dalilaqjillene.pages.dev

2024 Max Fsa Contribution Limits Irs Matti Shelley, Fsa limits 2024 carryover limit. The irs has just announced updated 2024 fsa contribution limits, which are seeing modest increases over 2023 amounts.

Source: kristiwnancy.pages.dev

Source: kristiwnancy.pages.dev

Irs Fsa Carryover To 2024 Jess Romola, Irs fsa carryover to 2024 jess romola, on. 1, 2024, the contribution limit for health fsas will increase another $150 to $3,200.

Source: salliewtalya.pages.dev

Source: salliewtalya.pages.dev

Irs Fica Limit 2024 Carin Cosetta, On november 10, via rev. However, the irs allows you to keep a certain amount from year to year.

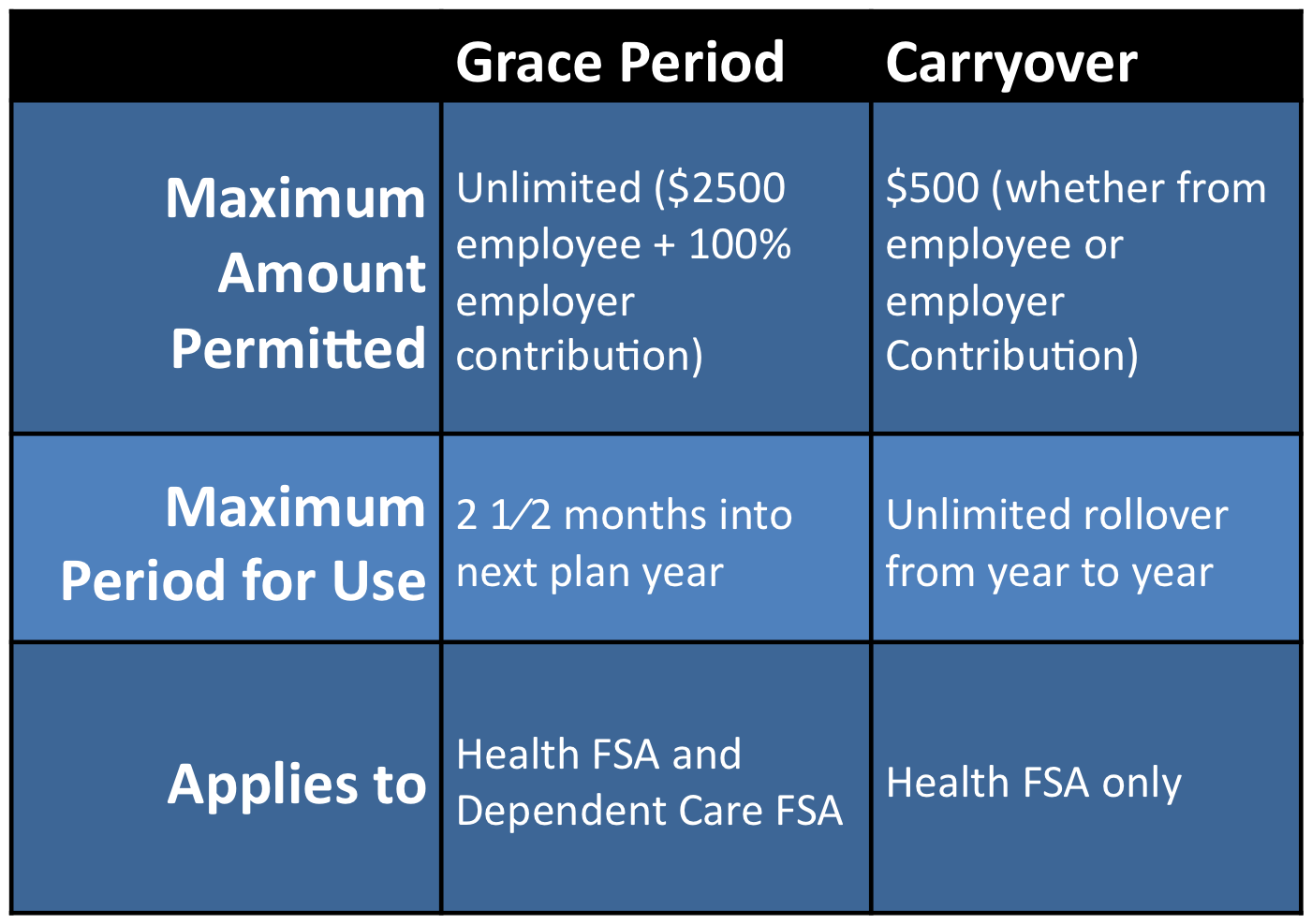

Fsa Carryover Limit 2024 Irs Maire Eleanor, The carryover feature typically allows you to roll over up to 20% of the maximum fsa contribution every year, if your employer allows it. An employee who chooses to participate in an fsa can contribute up to $3,200 through payroll deductions during the 2024 plan year.

Source: velmaqshelagh.pages.dev

Source: velmaqshelagh.pages.dev

Irs Fsa Max 2024 Joan Ronica, 2024 fsa maximum carryover amount: The internal revenue service (irs) announced new cola adjustments and maximum fsa contribution limits for 2025.

Source: kelleywdeonne.pages.dev

Source: kelleywdeonne.pages.dev

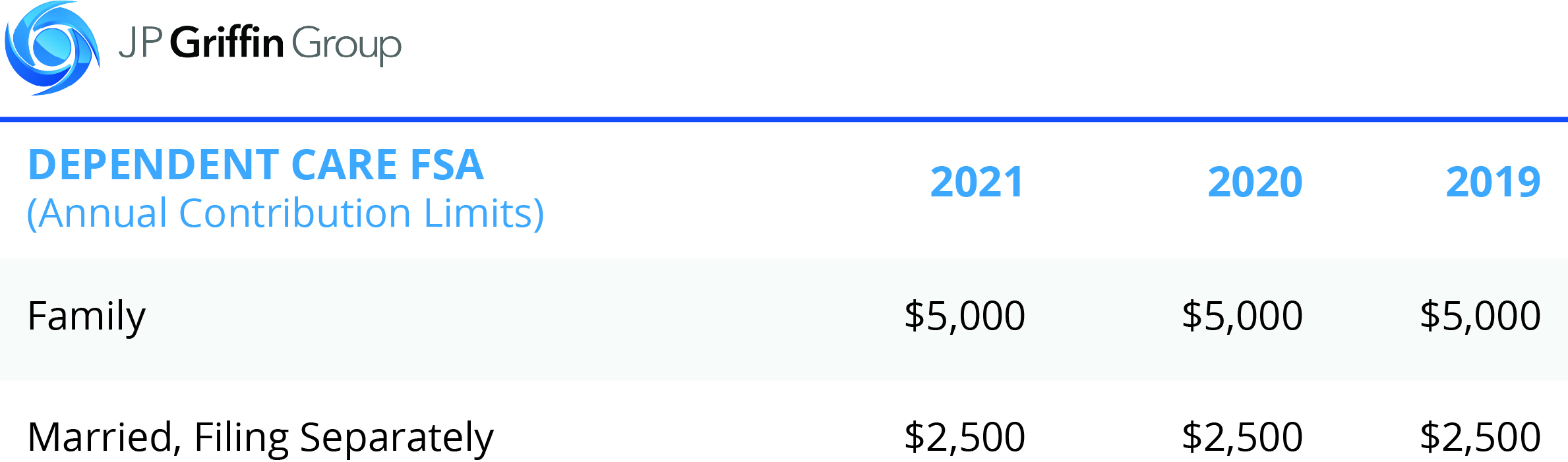

Irs Dependent Care Fsa Limits 2024 Nissa Leland, What about the carryover limit into 2025? The irs announced 2024 contribution limits for all flexible spending account (fsa) plans.

Source: erthaqmollie.pages.dev

Source: erthaqmollie.pages.dev

Irs 2024 Max 401k Contribution Limits Ruthy Peggie, On november 10, via rev. For fsas that permit the carryover of unused amounts, the maximum 2024 carryover amount to 2025 is $640.

Source: maudeqmaddalena.pages.dev

Source: maudeqmaddalena.pages.dev

2024 Fsa Carryover Amount Coral Karola, The irs has increased the flexible spending account (fsa) contribution limits for the health care flexible spending account (hcfsa) and the limited expense health care fsa (lex. The irs announced 2024 contribution limits for all flexible spending account (fsa) plans.

An Employee Who Chooses To Participate In An Fsa Can Contribute Up To $3,200 Through Payroll Deductions During The 2024 Plan Year.

For unused amounts in 2023, the maximum amount that.

The Irs Has Just Announced Updated 2024 Fsa Contribution Limits, Which Are Seeing Modest Increases Over 2023 Amounts.

Employees can now contribute $150 more this.

Posted in 2024